Salary sheet template is a pre designed document made by professionals to help others when making salary sheets for employees or workers. Salary sheet serve as a detailed summary of income generated by an employee or worker during the mentioned period of time. Salary Slip Format in Excel, Download Salary Calculation Sheet. Salary Slip Format XLS, Format of Salary Slip in Xls. Download Salary Slip Format in MS Excel Format. Salary Increase Template Excel, Compensation Metrics Calculations. This excel template is set up to calculate these metrics so you can review salary increase requests with ease and clarity. Great for an HR manager, generalist or small business owner and includes directions and a cheat sheet for understanding these compensation metrics.

Related Articles

- 1 Garnish Wages in Quickbooks

- 2 Change an Existing Employee's Withholdings in QuickBooks

- 3 Calculate the Budgeted Cost of Work Scheduled in Excel

- 4 Calculate Hourly Rates for Bonuses

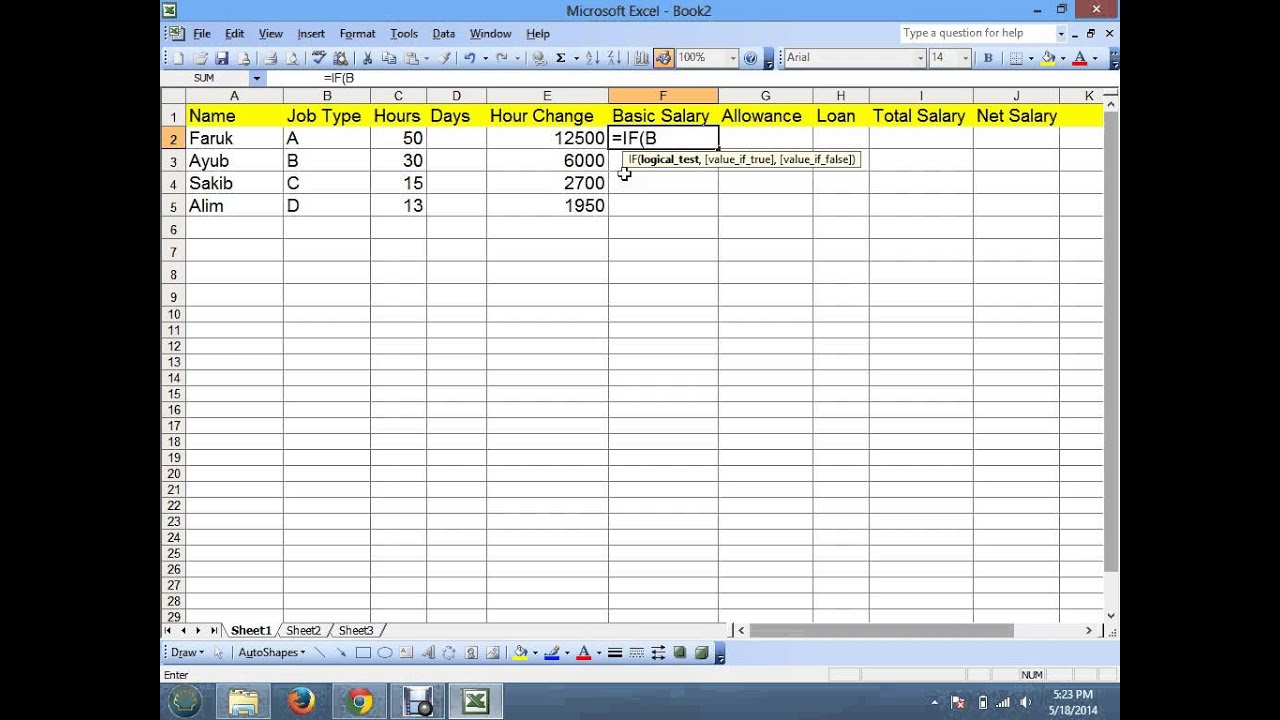

Using formulas in Microsoft Excel is a reliable method to calculate payroll for your business. Microsoft Excel contains over 300 built-in formulas to aid in the production of a functional worksheet. The 'IF' function is a logical test that assess whether a certain condition is met and returns a value according to the conditions. Using the 'IF' function in your worksheet, you can evaluate an employee's hours, determine the number of overtime hours and calculate the employee's gross salary.

Open a Microsoft Excel Spreadsheet

Open a Microsoft Excel spreadsheet.

Enter Employee Names

Click cell 'A1' and type 'Employee.' Press the 'Enter' key. Click cell 'A2' and type the name of the first employee. Continue entering each employee's name in column A.

Enter Employee ID Numbers

Click cell 'B1' and type 'Employee ID.' Press 'Enter.' Click cell 'B2' and type the employee ID of the first employee. Continue entering each employee's ID in column B.

Enter Employee Hourly Rates

Click cell 'C1' and type 'Hourly Rate.' Press the 'Enter' key. Click cell 'C2' and type the hourly rate of the first employee. Continue entering each employee's hourly rate in column B.

Enter Employee Total Hours

Click cell 'D1' and type 'Total Hours.' Press the 'Enter' key. Click cell 'D2' and type the total hours of the first employee. Continue entering each employee's total hours in column C.

Display Employee Regular Hours

Click cell 'E1' and type 'Regular Hours.' Press the 'Enter' key. Click cell 'E2' and type '=IF(D2>40,40,D2).' Press the 'Enter' key. This formula instructs Excel to display only the employee's regular hours.

Salary Calculator Excel

Copy the Formula for Each Employee

Click cell 'E2' and place your mouse at the lower-right corner of the cell. Your mouse pointer changes to a '+' sign. Click the corner of cell 'E2' and drag your mouse to copy the formula for each employee.

Multiply Regular Hours by Hourly Rate

Click cell 'F1' and type 'Regular Salary.' Press 'Enter.' Click cell 'F2' and type '=E2*C2' in the cell. Press the 'Enter' key. This formula multiplies the employee's regular hours by his hourly rate.

Copy the Formula for Each Employee

Click cell 'F2' and place your mouse at the lower-right corner of the cell. Your mouse pointer changes to a '+' sign. Click the corner of cell 'F2' and drag your mouse to copy the formula for each employee.

Display Hours Over 40

Click cell 'G1' and type 'Overtime Hours.' Press 'Enter.' Click cell 'G2' and type ' =IF(D2>40,D2-40,'0')' in the cell. Press the 'Enter' key. This formula evaluates the employee's total hours and displays only hours over 40. If the employee has less than 40 hours, the cell displays a '0.'

Copy the Formula for Each Employee

Click cell 'G2' and place your mouse at the lower-right corner of the cell. Your mouse pointer changes to a '+' sign. Click the corner of cell 'G2' and drag your mouse to copy the formula for each employee.

Multiply Overtime Hours by Overtime Rate

Click cell 'H1' and type 'Overtime Salary.' Press the 'Enter' key. Click cell 'H2' and type '=(C2_1.5)_G2' in the cell. Press 'Enter.' This formula multiplies the employee's overtime hours by the general overtime rate of time and a half.

Copy the Formula for Each Employee

Click cell 'H2' and place your mouse at the lower-right corner of the cell. Your mouse pointer changes to a '+' sign. Click the corner of cell 'H2' and drag your mouse to copy the formula for each employee.

Add Regular Salary and Overtime

Click cell 'I1' and type 'Gross Salary.' Press 'Enter.' Click cell 'I1' and type ' =H2+F2' in the cell. Press the 'Enter' key. This formula adds the employee's regular salary and any overtime.

Copy the Formula for Each Employee

Click cell 'I2' and place your mouse at the lower-right corner of the cell. Your mouse pointer changes to a '+' sign. Click the corner of cell 'I2' and drag your mouse to copy the formula for each employee.

Format the Cells to Dollars

Click cell 'C2' and drag your mouse to highlight each employee's hourly rate. Click the 'Home' tab and click the '$' sign in the 'Number' group to format the cells to include a dollar sign and increase the number to two decimal places. Apply this format to the dollar amounts in column 'F,' 'H' and 'I.'

Apply Formatting to Cells

Click cell 'A1' and drag your mouse to cell 'I1.' Click the 'Home' tab and click the 'B' sign in the 'Font' group to apply bold formatting to the cells.

Salary Calculator Excel Sheet

Tip

If an employee is a salary employee and does not have an hourly rate nor receives overtime for hours worked over 40, type the employee's salary amount in column 'F.'

References (2)

About the Author

Angela M. Wheeland specializes in topics related to taxation, technology, gaming and criminal law. She has contributed to several websites and serves as the lead content editor for a construction-related website. Wheeland holds an Associate of Arts in accounting and criminal justice. She has owned and operated her own income tax-preparation business since 2006.

Cite this ArticleChoose Citation Style

If you are an employer or a self-employed individual it is your responsibility to pay your taxes on time. After withholding the tax deductions the employer can release pay checks to the staff. Now the problem faced by many of the small firms is to know how to calculate the amount of withholdings and the net take home pay.

Paycheck Calculator is a simple and automated way of calculating the salaries and the taxable withholdings. In case of an employer, it is his sole responsibility to calculate tax and deduct that amount from the gross value. Apart from this even the individual has to declare his/her other means of income other than the salary being received. You have to pay tax on the net income earned from all the sources.

Microsoft Excel® 2007 or Higher (PC & Mac)

Not Required

User License Agreement

Using Paycheck Calculator

Pay Check Calculator requires the details of the latest tax rates imposed by the government to calculate the correct taxes. The sheet has three main sections, first one is used to show the Gross Pay, second one for calculating your pay check and a third one is a graphical representations of the pay check.

This template makes use of Federal Tax brackets to understand the final calculations. These brackets are included into the subsequent worksheets. The tables are Federal Tax table and California Tax table (for California pay check calculator only). The tax brackets from these two worksheets are used to calculate the net amount of your pay check. The tables should be updated annually as per the government rules.

Net Pay Check Calculator (California)

for Excel® 2007+Microsoft Excel® 2007 or Higher (PC & Mac)

Not Required

Salary Calculation Formula In Excel Sheet

User License Agreement

Employer releases the pay checks weekly, bi-weekly, semi-monthly, monthly, quarterly, semi-annually and annually depending on the employee type. You need to enter the employee details like the Gross Pay, Payment Frequency, Filing status, Number of Allowances, Pre- Tax Withholdings, State and Local Tax details, FICA (Federal Insurance Contribution Act) details, Post Tax Deductions and Post Tax Reimbursements.

This template is best for individuals and professionals like Charted Accountants who have to calculate pay checks for many individuals. It is very important to deduct the correct withholdings and to submit the transparent and clear records. You cannot afford to make a single mistake as it can land you up in penalties as per law. This is the most flexible, fast and accurate way of filing your taxes. All your federal and state taxes are automatically calculated and you can be assured of its correctness with this template. Whether your social status is Single, Married or Unmarried (Head of family), it takes care of all through its method tables.

Tax filing is otherwise considered a cumbersome and a complex task. But the Pay Check Calculator is strongly recommended for you, if you are doing this tedious task on your own or for many individuals. Paying taxes on time saves you from the hassle of legal battles or late payment charges if any. Tax are the most important source of revenue for the government, it is this money that is used by the government in development and civic maintenance.